Under ARP, the child tax credit has been enhanced for 2021. For more information on who is eligible for the premium tax credit, see the Instructions for Form 8962. If you don’t wish to claim the premium tax credit for 2021, you don’t need the information in Part II of Form 1095-C. You may rely on other information received from your employer. However, you do not need to wait to receive this form to file your return. This information may be relevant if you purchased health insurance coverage for 2020 through the Health Insurance Marketplace and wish to claim the premium tax credit on Schedule 3, line 8. You should receive Form 1095-C by early February 20221. Part II of Form 1095-C shows whether your employer offered you health insurance coverage and, if so, information about the offer. If you or someone in your family was an employee in 2021, the employer may be required to send you a Form 1095-C. Include Form 8962 with your Form 1040, or Form 1040-SR, or Form 1040-NR. You will need Form 1095-A from the Marketplace.Ĭomplete Form 8962 to claim the credit and to reconcile your advance credit payments. Please click here for the text description of the image.

Have other payments, such as an amount paid with a request for an extension to file or excess social security tax withheld or have a deferral of tax (for certain Schedule H and Schedule SE filers). IF YOU can claim a refundable credit (other than the earned income credit, American opportunity credit, refundable child tax credit, additional child tax credit, or recovery rebate credit), such as the net premium tax credit, health coverage tax credit, or qualified sick and family leave credits from Schedule H or Schedule SE. IF YOU can claim a nonrefundable credit (other than the child tax credit or the credit for other dependents), such as the foreign tax credit, education credits, general business credit. IF YOU owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts.

IF YOU owe AMT or need to make an excess advance premium tax credit repayment. IF YOU have additional income such as capital gains, unemployment compensation, prize or award money, gambling winnings have any deductions to claim, such as student loan interest, self-employment tax, educator expenses.

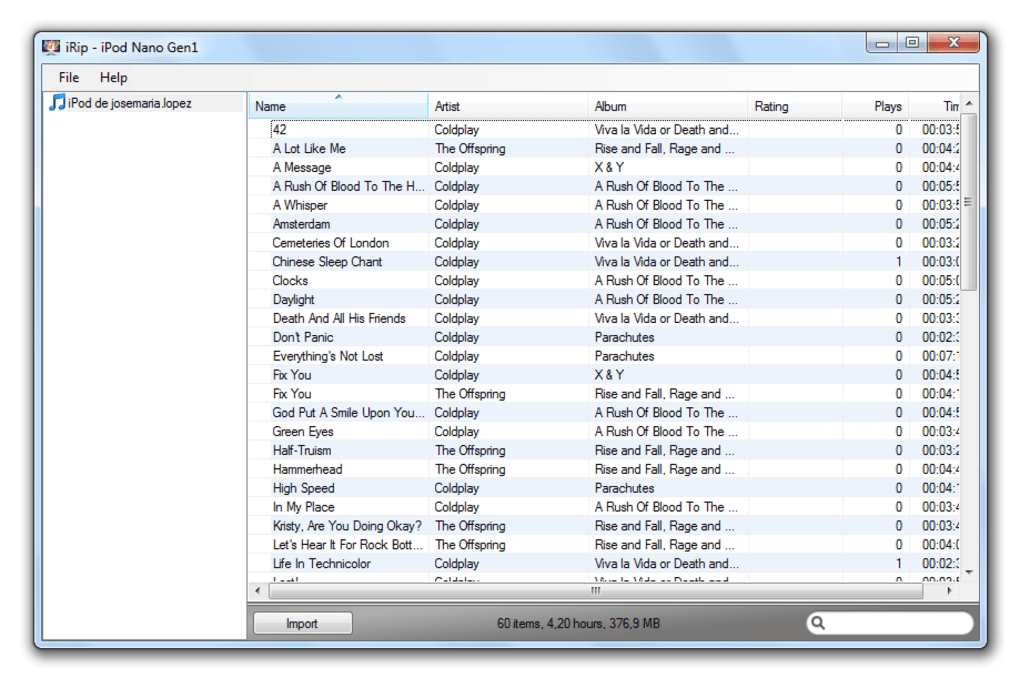

IRIP INSTRUCTIONS SOFTWARE

If you e-file your return, you generally won’t notice much of a change and the software you use will generally determine what schedules you need. See the instructions for the schedules for more information. Below is a general guide to what schedule(s) you will need to file based on your circumstances. However, if your return is more complicated (for example, you claim certain deductions or owe additional taxes), you will need to complete one or more of the numbered schedules. Many people will only need to file Form 1040 or 1040-SR and none of the numbered schedules, Schedules 1 through 3. For 2021, you will use Form 1040 or, if you were born before January 2, 1957, you have the option to use Form 1040-SR.

0 kommentar(er)

0 kommentar(er)